It’s been said that for any lasting relationship, both partners need to understand, appreciate and quite possibly share the same “love languages.” Knowing the love languages of your partner helps you to better express your affection towards someone and to better interpret how your partner loves you.

John Mackey, Whole Foods co-founder and ceo, used the metaphor of marriage to describe Amazon acquiring Whole Foods. Mackey said, “It’s been a whirlwind courtship. Because, little over six weeks after we met on this blind date, we’re officially engaged.”

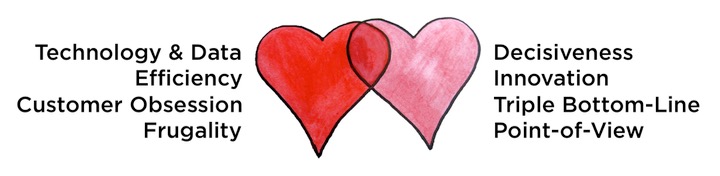

That marriage metaphor sparked me to think about what “love languages” have driven both Amazon and Whole Foods to achieve business success. In this context, love languages are the cultural and operational underpinnings that have fueled the success at both companies.

Having worked at Whole Foods as their director of national marketing in the early 2000s, I have a much greater understanding of Whole Foods love languages than I do of Amazon’s. However, I’ve studied Amazon enough, to know enough, to make a few observations.

Listed below are eight love languages that help to explain some of the foundational business aspects Amazon and Whole Foods have used to become beloved brands.

Technology & Data

Amazon is a digital company with zettabytes of data about how its customers behave. They use this information to make the smartest decisions possible.

Whole Foods is a retail business with loads of customer data but its physical locations and store-level operations make it a deeply-rooted analog business.

Efficiency

Amazon has been built to be highly efficient in every way it does business. Its fulfillment centers are wonders of logistical design and its growing global transportation network is threatening to upend UPS and FedEx.

Whole Foods is decidedly inefficient. The company places significant responsibilities to its twelve regions to solve for procurement, distribution and scores of other duties that retailers of its similar size centralize in order to bring about efficiency. This inefficiency was designed to give Whole Foods greater ability to localize the brand in the communities it serves.

Customer Obsession

Amazon prides itself on being obsessive about customers. Jeff Bezos, Amazon founder/ceo, believes, “We’ve had three big ideas at Amazon that we’ve stuck with for 18 years, and they’re the reason we’re successful: Put the customer first. Invent. And be patient.”

Whole Foods is designed to deliver awesome in-store customer experiences but if the company was truly obsessed with customers then it would’ve have solved for delivering lower prices to customers years ago.

Frugality

Amazon is notorious for being a frugal company. Frugality is a core Amazon operating principle: Accomplish more with less. Constraints breed resourcefulness, self-sufficiency and invention. There are no extra points for growing headcount, budget size or fixed expense.

Whole Foods practices frugality but not near to the extent of Amazon. The frugality practiced at Whole Foods is more geared towards sustainability practices of reduce, reuse, recycle.

Decisiveness

Amazon practices something Jeff Bezos calls “high-velocity decision making.” It’s where speed meets smarts. Bezos believes, “Most decisions should probably be made with somewhere around 70 percent of the information you wish you had. If you wait for 90 percent, in most cases, you’re probably being slow.” He trusts that if/when a decision starts to look bad, his teams will be able to recognize the issue and make a quick course correction.

Whole Food makes decisions by consensus and that takes time and lots of meetings. If Amazon waits for 70 percent of the information to make a decision then Whole Foods waits for 99 percent of the information. Empathy drives so much of the culture at Whole Foods and that empathetic ear translates into having to hear all sides to every story many times over before a decision can be made.

Innovation

Amazon is a retail pioneer. They have changed, are changing and will continue to change the digital retail landscape.

Whole Foods was a retail pioneer. They proved a global retail grocery chain could be built focused on selling natural/organic products and humanely raised meat/poultry/fish. Competitors ranging from Costco to Walmart to Target to Trader Joe’s have surpassed Whole Foods in a few meaningful ways.

Triple Bottom-Line

Amazon doesn’t follow the triple bottom-line philosophy of people, planet and profits. Its environmental and people practices continue to be scrutinized. The company discloses very little about its carbon footprint amidst its growing global distribution network. Amazon has also had to answer to questions about its treatment of employees. To my knowledge, Amazon has never been listed as one of Fortune’s 100 best companies to work for in America.

Whole Foods is a leading business practicing “conscious capitalism” where business decisions are based and measured upon the impact to people, planet and profit. It has a longstanding reputation for supporting and advancing environmental concerns. The company is celebrated for being an employer of choice having been listed for 20 consecutive years by Fortune magazine as being one of the best companies to work for in America.

Point-of-View

Amazon’s retail point-of-view is strictly operational. It’s all about making it easier for customers to do business with them. Huge Selection. Low prices. One-click buying. Fast shipping. Liberal return policy. Speedy customer service. All of these factors make it easier for customers to remain loyal to Amazon.

Whole Foods point-of-view is staunchly aspirational. The company promotes a lifestyle of eating wholesome foods that do not contain anything artificial. Whole Foods has been at the forefront of setting organic standards and promoting eating a plant-based diet. Mackey has routinely said, “We’re in the business of selling whole foods, not holy foods.” Despite that, Whole Foods strong point-of-view on what’s healthy can alienate customers who must go elsewhere to purchase products that Whole Foods deems unhealthy.

CONCLUSION

Just because Amazon and Whole Foods speak different love languages doesn’t mean their impending marriage is setup to fail. However, it does mean they will need to communicate often and the partnership will need to be open to change.

Let’s be real. Whole Foods Market isn’t a healthy business. Comparable store sales are on a downward trend. Its stock price had stagnated. Competition has increased. Pricing pressures have hurt profitability. New store growth has slowed. For those reasons and more, Jana Partners, an activist investment firm, purchased nearly 10% of Whole Foods Market and pushed for big changes.

Amazon is a retail behemoth. They’ve changed the retail game in the digital era like Walmart did before the internet became omnipresent. Today, Amazon accounts for nearly 35% of all U.S. online sales. Expectation is that by 2021, Amazon’s online retail market share will grow to 50%.

With a $500 billion market capitalization, some industry folks have said the $13.7 billion purchase price for Whole Foods is a “rounding error” for Amazon. In many ways, Amazon risks little with this purchase. On the other side, Whole Foods risks a lot.

What’s at stake is more about Whole Foods point-of-view and its willingness to adapt to a new retail landscape.

The Altar Alters Little

With this proposed marriage, both Amazon and Whole Foods need to fully accept what makes each business unique. If Amazon tries to change Whole Foods too much then the marriage will fail. Whole Foods cultural and operational underpinnings have very strong roots and trying to change the core of what makes Whole Foods a beloved brand has the potential to crumble the relationship.

Consummating a relationship at the altar will not alter the core of what makes each partner unique. Amazon will be smart to hold off on its high velocity decisiveness and allow for time to better understand its marriage partner. For Whole Foods, the company needs to be open to evolving and incorporating more of the customer obsession mentality that has made Amazon outrageously successful.